Zen JV, LLC, the parent entity behind well-known recruitment brands like CareerBuilder and Monster Worldwide, has filed for Chapter 11 bankruptcy in the District of Delaware. The filing includes ten affiliated entities and initiates a formal liquidation strategy through a structured sale of assets. With estimated liabilities between $100M and $500M and assets valued at $50M to $100M, the company seeks to wind down operations while preserving job continuity for transitioning employees. The company has already entered into several stalking horse agreements and secured DIP financing led by BlueTorch Capital to facilitate the process. Notable creditors include Google, Textkernel, and JobGet, signaling significant exposure to marketing and technology vendors.

June 24, 2025 — Wilmington, DE

In a definitive close to the legacy of two of the most iconic brands in online recruitment history, Zen JV, LLC—the parent company of CareerBuilder and Monster Worldwide—has filed for Chapter 11 bankruptcy in the District of Delaware. Alongside Zen JV, nine of its subsidiaries have simultaneously filed for bankruptcy protection, initiating a full-scale liquidation of assets and winding down all operations.

This coordinated action marks the formal and irreversible dismantling of a recruitment empire that once shaped how millions of people searched for jobs and how employers discovered talent. As the industry pivots toward AI-driven talent platforms and decentralized workforce solutions, the failure of Zen JV underscores a stark truth: the age of traditional job boards is officially over.

A Structured Collapse: Ten Companies Enter Chapter 11

According to court documents filed on June 24, 2025, the following entities under Zen JV have jointly filed for bankruptcy:

Zen JV, LLC

Monster Worldwide, LLC

CareerBuilder, LLC

CareerBuilder France Holding, LLC

Monster Government Solutions, LLC

CareerBuilder Government Solutions LLC

Luceo Solutions, LLC

Military Advantage, LLC

Camaro Acquisition, LLC

FastWeb, LLC

Zen JV estimates its consolidated assets between $50 million and $100 million, while liabilities stand in the range of $100 million to $500 million, with no available funds for distribution to unsecured creditors after administrative expenses. The company reports between 1,000 and 5,000 creditors, signaling the wide footprint of its operations and obligations.

Asset Sales Already Underway

In a pre-packaged move to maximize asset value, Zen JV has already signed three Stalking Horse Agreements with the following buyers:

JobGet Inc. and CBM Acquisition LLC – Targeting the core CareerBuilder and Monster assets

Valsoft Corporation Inc. – Targeting Monster Government Solutions

Valnet US Inc. – Targeting Military Advantage and FastWeb

These transactions will undergo court-supervised bidding procedures, giving other interested buyers an opportunity to make competitive offers. The stated goal is to transition key technologies, platforms, and potentially employees to new ownership while closing the door on Zen JV's own operational future.

To support operations during the bankruptcy process, Zen JV secured Debtor-in-Possession (DIP) financing from BlueTorch Capital. Advisors on the bankruptcy and sale process include:

PJT Partners (Investment Banker)

AlixPartners (Financial Advisor)

Latham & Watkins LLP and Richards, Layton & Finger P.A. (Legal Counsel)

Omni Agent Solutions (Claims and Noticing Agent)

Major Unsecured Creditors Revealed

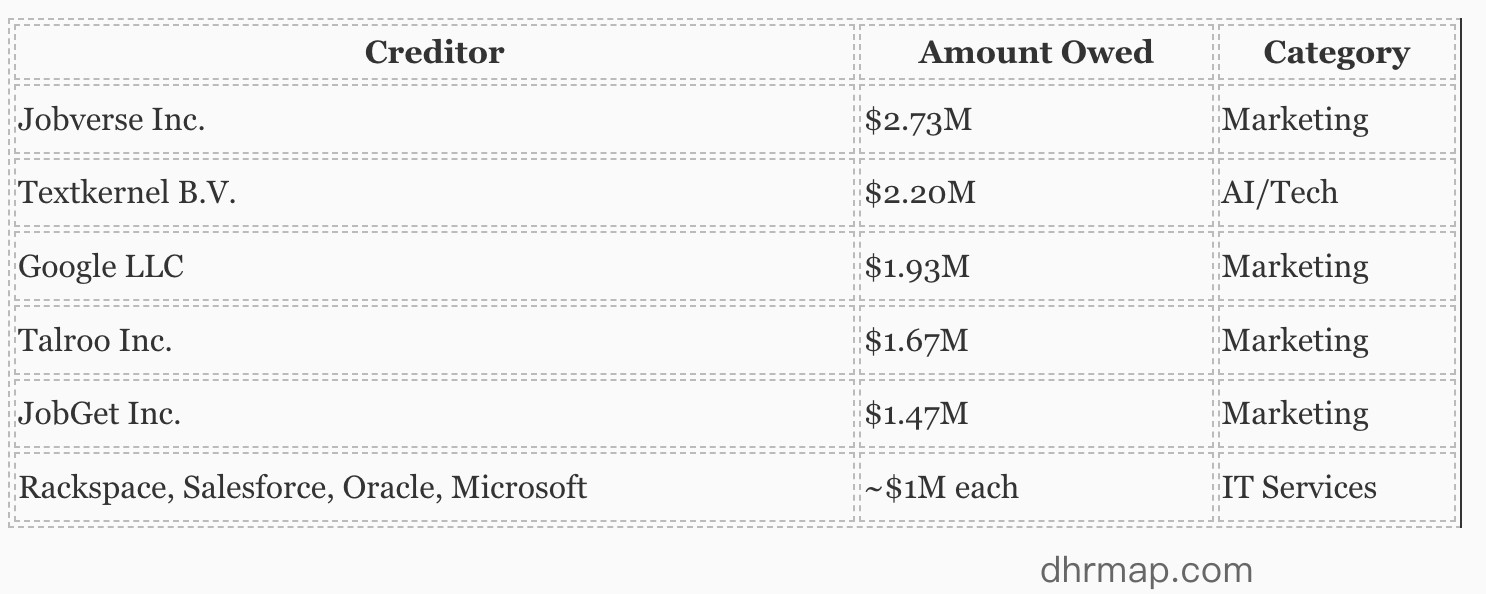

A list of the top 30 unsecured creditors reveals the company’s heavy dependence on marketing and technology service providers. Notable claims include:

This reflects the company’s continued investments in marketing and cloud infrastructure, even amid financial headwinds.

Complex Ownership Structure

Zen JV is a joint venture held by three entities:

Camaro Holdings, LLC – 51% Class A and 35.65% Class B

Randstad MWW Inc. – 49% Class A and 49% Class B

2584172 Ontario Inc. – 15.35% Class B only

This layered governance structure, including multiple tiers of wholly-owned subsidiaries, illustrates the fragmentation that likely complicated turnaround efforts. Randstad’s involvement dates back to its 2016 acquisition of Monster Worldwide for $429 million.

CareerBuilder: A Trailblazer’s Rise and Fall

Founded in 1995, CareerBuilder was once considered the gold standard in online recruitment. Originally backed by a consortium of newspapers, the platform thrived in the early 2000s by embedding its job listings across thousands of local news websites. Strategic partnerships with Microsoft, AOL, and Yahoo amplified its reach.

At its peak, CareerBuilder was the most-visited job board in the United States and expanded internationally through acquisitions like Broadbean and EMSI. However, the platform struggled to transition to mobile-first and AI-enabled hiring ecosystems. Following years of declining relevance, Tegna divested CareerBuilder in 2017 to a private equity consortium led by Apollo Global and GTCR, which placed it under the Camaro Holdings umbrella and later Zen JV.

Despite rebranding attempts and investments in resume-matching and data tools, CareerBuilder could not regain its competitive edge. By 2023, most of its global business units had either been shuttered or sold off.

Monster Worldwide: The Original Online Job Board

Monster’s history is even more storied. Launched in 1994 as The Monster Board, it is widely credited as the first online job platform. By 2000, Monster.com had become a household name in recruitment, even running Super Bowl ads to cement its dominance.

In the mid-2000s, Monster aggressively pursued global expansion and was once valued at over $6 billion. However, it failed to adapt to mobile, social, and algorithmic recruitment models. After years of declining revenue, it was acquired by Randstad in 2016 and merged into Zen JV in later years.

Monster’s remaining government and defense-oriented hiring operations were its last functioning assets before this bankruptcy filing.

Industry Implications: Traditional Job Boards Are Over

Zen JV’s collapse reflects a broader industry transformation. Traditional job boards—reliant on paid listings and resume banks—are increasingly obsolete in the face of AI-native hiring solutions. Platforms like SeekOut, Eightfold AI, and Beamery, which leverage skills graphs, behavioral data, and automation, now define the future of recruiting.

Meanwhile, vertical platforms (e.g., JobGet, Upwork, Hirect) and community-driven ecosystems are displacing the one-size-fits-all approach. CareerBuilder and Monster simply could not keep pace with innovation, and their downfall signals the end of an era.

Conclusion: A Historic Exit and a Strategic Reset

The bankruptcy of Zen JV and the divestiture of CareerBuilder and Monster mark the formal conclusion of two of the recruitment industry’s most iconic brands. For many HR professionals, these platforms were the original gateways to digital talent acquisition. Their legacy endures—but their business models no longer resonate with the expectations of modern employers or job seekers.

As assets transition to new owners, and former competitors absorb customer bases, this moment serves as both a eulogy and a lesson. In a world defined by automation, personalization, and AI-driven insights, only those who evolve will endure.

For more insights into HR tech transformations and talent market shifts, follow DHRmap.com — your global source for HR innovation news.

Subscribe to our newsletter and never miss our latest digital HR news!

By signing up to receive DHRmap newsletter, you agree to our Terms of Use and Privacy Policy. You can unsubscribe anytime.