ADP reported a robust fiscal third quarter for 2024 with significant growth across key financial metrics. Revenues rose by 7% to $5.3 billion, driven by solid performance in both Employer Services and PEO Services. Net earnings increased by 14% to $1.2 billion, and adjusted EBIT grew by 12% to $1.5 billion, reflecting an enhanced adjusted EBIT margin of 29.3%. Diluted EPS saw a 15% increase, reaching $2.88. The company attributes these positive outcomes to strong client retention and new business bookings, alongside a stable demand in the Human Capital Management (HCM) sector. Looking forward, ADP remains committed to reinvestment for sustained growth and shareholder profitability.

ADP Reports Third Quarter Fiscal 2024 Results

•Revenues increased 7% compared to last year's third quarter to $5.3 billion; 6% organic constant currency

•Net earnings increased 14% to $1.2 billion, and adjusted net earnings increased 13% to $1.2 billion

•Adjusted EBIT increased 12% to $1.5 billion, and adjusted EBIT margin increased 140 basis points to 29.3%

•Diluted earnings per share ("EPS") increased 15% to $2.88; adjusted diluted EPS increased 14% to $2.88

ROSELAND, N.J. – May 1, 2024 –

ADP(Nasdaq: ADP), a leading global technology company providing human capital management (HCM) solutions, today announced its third quarter fiscal 2024 financial results and updated its fiscal 2024 outlook.

Third Quarter Fiscal 2024 Consolidated Results

Compared to last year’s third quarter, revenues increased 7% to $5.3 billion and 6% on an organic constant currency basis. Net earnings increased 14% to $1.2 billion, and adjusted net earnings increased 13% to $1.2 billion. Adjusted EBIT increased 12% to $1.5 billion, representing an adjusted EBIT margin increase of 140 basis points in the quarter to 29.3%. ADP’s effective tax rate for the quarter was 23.4% on both a reported basis and an adjusted basis. Diluted EPS increased 15% to $2.88, and adjusted diluted EPS increased 14% to $2.88.

“Healthy new business bookings and client retention contributed to our strong third quarter results," said Maria Black, President and Chief Executive Officer, ADP. “We strive to deliver innovative products, differentiated service, and exceptional experiences every day, and we are proud these efforts helped to drive new record highs in client satisfaction this fiscal year. With a stable HCM demand backdrop, we are focused on executing in the fourth quarter and building momentum into fiscal 2025."

"With good outcomes in revenue, margin, and earnings growth in the third quarter, we are positioned for strong overall fiscal 2024 results," said Don McGuire, Chief Financial Officer, ADP. "As we look ahead, we remain committed to reinvesting in our business to drive long-term profitable growth for our shareholders."

Adjusted EBIT, adjusted EBIT margin, adjusted net earnings, adjusted diluted earnings per share, adjusted effective tax rate and organic constant currency are all non-GAAP financial measures. Please refer to the accompanying financial tables at the end of this release for a discussion of why ADP believes these measures are important and for a reconciliation of non-GAAP financial measures to their closest comparable GAAP financial measures.

Third Quarter Segment Results

Employer Services – Employer Services offers a comprehensive range of global HCM and Human Resources Outsourcing solutions. Compared to last year's third quarter:

•Employer Services revenues increased 8% on a reported basis and 7% on an organic constant currency basis

•U.S. pays per control increased 2%

•Employer Services segment margin increased 230 basis points

PEO Services – PEO Services provides comprehensive employment administration outsourcing solutions. Compared to last year's third quarter:

•PEO Services revenues increased 5%

•PEO Services revenues excluding zero-margin benefits pass-throughs increased 2%

•Average worksite employees paid by PEO Services increased 3% to about 732,000

•PEO Services segment margin decreased 220 basis points

Included within the results of our segments above:

Interest on Funds Held for Clients – The safety, liquidity, and diversification of ADP clients’ funds are the foremost objectives of the Company’s investment strategy. Client funds are invested in accordance with ADP’s prudent and conservative investment guidelines, and most of the investment portfolio is rated AAA/AA. Compared to last year's third quarter:

•Interest on funds held for clients increased 29% to $321 million

•Average client funds balances increased 6% to $41.7 billion

•The average interest yield on client funds increased 50 basis points to 3.1%

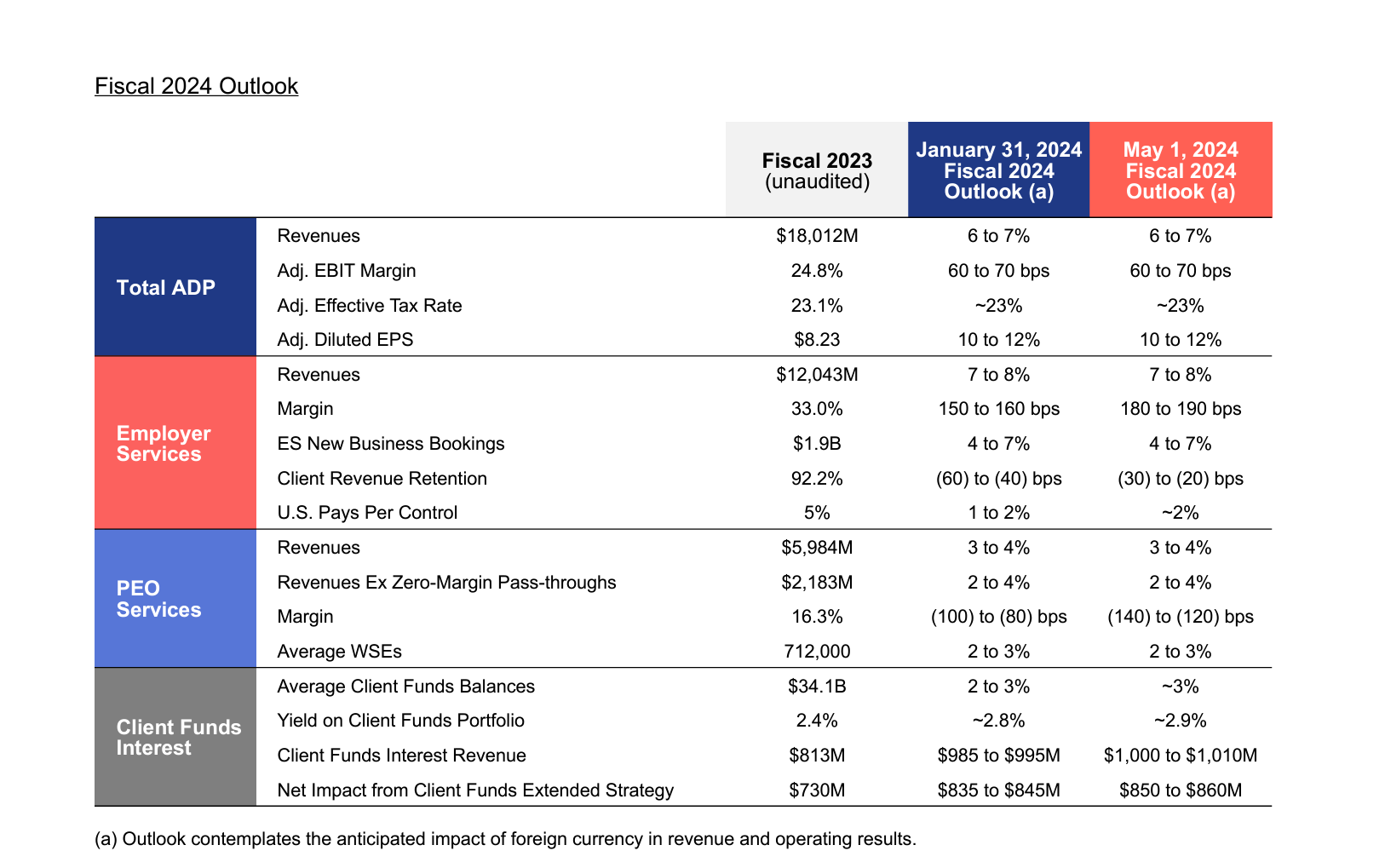

Certain components of ADP’s fiscal 2024 outlook and related growth comparisons exclude the impact of the following items and are discussed on an adjusted basis where applicable. Please refer to the accompanying financial tables for a reconciliation of these adjusted amounts to their closest comparable GAAP measure.

•Fiscal 2023 pre-tax charges of about $9 million related to transformation initiatives

•Fiscal 2023 pre-tax charges of about $1 million related to legal settlements

•Fiscal 2024 expected pre-tax charges of about $5 million related to transformation initiatives

Consolidated Fiscal 2024 Outlook

•Revenue growth of 6% to 7%

•Adjusted EBIT margin expansion of 60 to 70 basis points

•Adjusted effective tax rate of about 23%

•Diluted EPS growth of 10% to 12%

•Adjusted diluted EPS growth of 10% to 12%

Employer Services Segment Fiscal 2024 Outlook

•Employer Services revenue growth of 7% to 8%

•Employer Services margin up 180 to 190 basis points

•Employer Services new business bookings growth of 4% to 7%

•Employer Services client revenue retention decrease of 20 to 30 basis points

•Increase in U.S. pays per control of about 2%

PEO Services Segment Fiscal 2024 Outlook

•PEO Services revenue growth of 3% to 4%

•PEO Services revenue, excluding zero-margin benefits pass-throughs, growth of 2% to 4%

•PEO Services margin down 120 to 140 basis points

•PEO Services average worksite employee count growth of 2% to 3%

Client Funds Extended Investment Strategy Fiscal 2024 Outlook

The interest assumptions in our outlook are based on Fed Funds futures contracts and various forward yield curves as of April 30, 2024. The Fed Funds futures contracts are used in the client short and corporate cash interest income outlook. A combination of various forward yield curves that reflect our investment mix, resulting in a blended rate of 4.5%, was used to forecast new purchase rates across the client and corporate extended and client long portfolios over the remainder of the fiscal year.

•Interest on funds held for clients of $1.0 billion to $1.01 billion; this is based on anticipated growth in client funds balances of about 3% and an average yield that is anticipated to increase to 2.9%

•Total contribution from the client funds extended investment strategy of $850 to $860 million

Investor Webcast Today

As previously announced, ADP will host a conference call for financial analysts today, Wednesday, May 1, 2024 at 8:30 a.m. ET. The conference call will be webcast live on ADP’s website at investors.adp.com and will be available for replay following the call. A slide presentation accompanying the webcast is also available at investors.adp.com/events-and-presentations. ADP news releases, current financial information, SEC filings, and Investor Relations presentations are posted to ADP’s website at investors.adp.com.

About ADP (Nasdaq: ADP)

Designing better ways to work through cutting-edge products, premium services, and exceptional experiences that enable people to reach their full potential. HR, Talent, Time Management, Benefits, and Payroll. Informed by data and designed for people. Learn more at ADP.com.