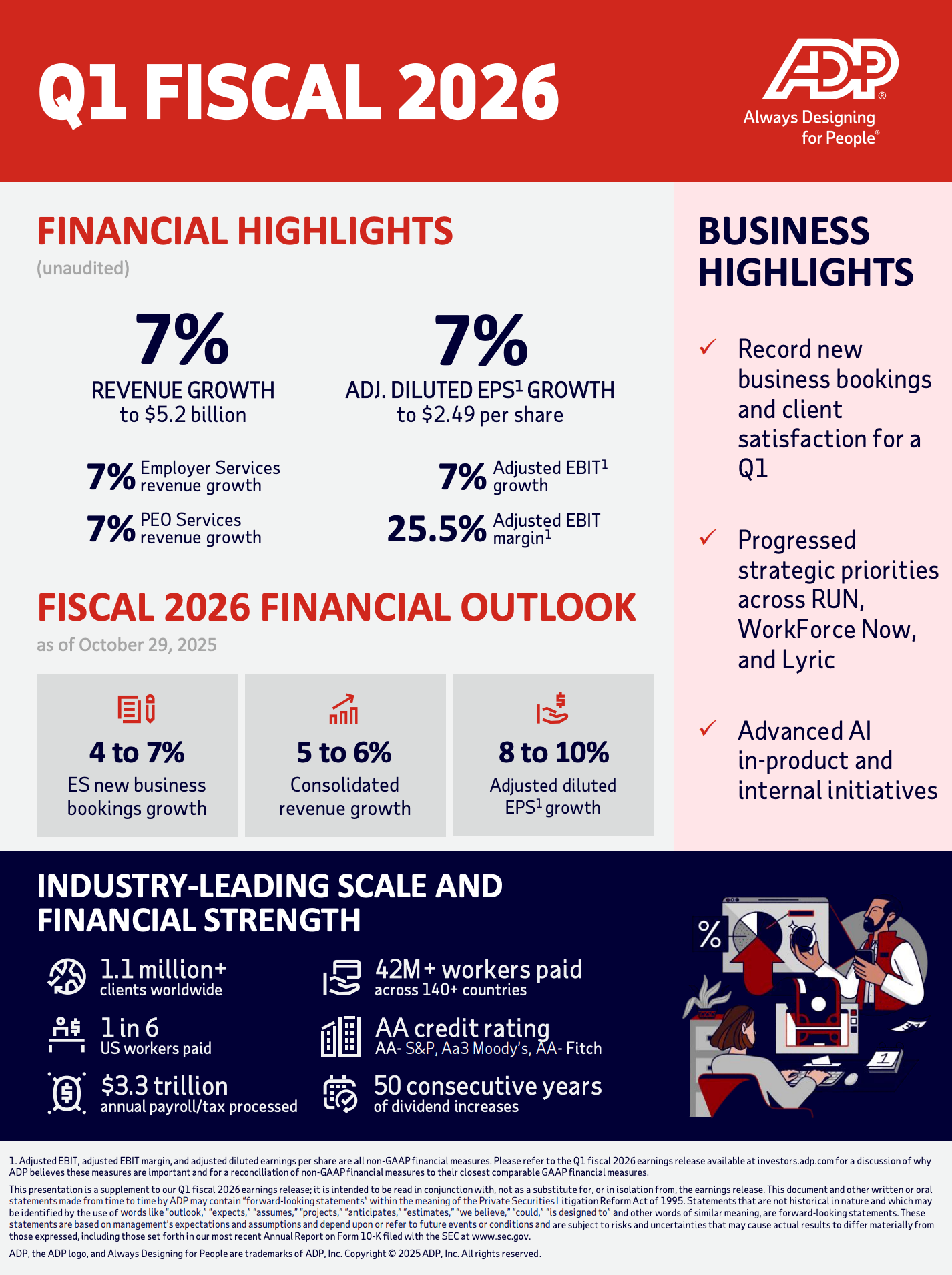

• Revenues increased 7% compared to last year's first quarter to $5.2 billion; 6% organic constant currency

• Net earnings increased 6% to $1.0 billion, and adjusted net earnings increased 6% to $1.0 billion

• Adjusted EBIT increased 7% to $1.3 billion, and adjusted EBIT margin remained flat at 25.5%

• Diluted earnings per share ("EPS") increased 6% to $2.49; adjusted diluted EPS increased 7% to $2.49

• Maintaining fiscal 2026 consolidated outlook for revenue growth of 5% to 6%, adjusted EBIT margin expansion of 50 to 70 basis points, and adjusted diluted EPS growth of 8% to 10%

ROSELAND, N.J. – October 29, 2025 – ADP (Nasdaq: ADP), a global leader in HR and payroll solutions, today announced its first quarter fiscal 2026 financial results and updated its fiscal 2026 outlook.

First Quarter Fiscal 2026 Consolidated Results

Revenues increased 7% to $5.2 billion and 6% on an organic constant currency basis. Net earnings increased 6% to $1.0 billion, and adjusted net earnings increased 6% to $1.0 billion. Adjusted EBIT increased 7% to $1.3 billion, and adjusted EBIT margin remained flat at 25.5%. ADP’s effective tax rate for the quarter was 22.5% on both a reported and adjusted basis. Diluted EPS increased 6% to $2.49, and adjusted diluted EPS increased 7% to $2.49.

CEO Commentary

“Fiscal 2026 started off with solid financial performance and meaningful progress across our strategic priorities,” said Maria Black, President and CEO of ADP. “We continue to drive strong outcomes for clients, as exemplified by our record client satisfaction levels and continued robust retention results. We also continue to infuse AI into our products and operations to solve real-world HR problems and fundamentally shift how work gets done.”

CFO Peter Hadley added, “Our first quarter revenue and margin performance exceeded expectations, driven by strong new business bookings, client revenue retention, and higher client funds interest revenue. We look forward to delivering strong financial performance in fiscal 2026, as we continue to make strategic investments to support long-term growth.”

Segment Results

Employer Services – Revenues increased 7% (5% organic constant currency). U.S. pays per control approximately flat. Segment margin decreased 50 basis points.

PEO Services – Revenues increased 7%; excluding zero-margin benefits pass-throughs, +6%. Average worksite employees (WSEs) increased 2% to 754,000. Segment margin decreased 140 basis points.

Client Funds Interest

Interest on funds held for clients increased 13% to $287 million. Average client funds balances rose 7% to $34.9 billion. Average interest yield increased 20 basis points to 3.3%. Most of ADP’s portfolio remains rated AAA/AA.

Fiscal 2026 Outlook

Revenue growth: 5%–6%

Adjusted EBIT margin expansion: +50–70 bps

Adjusted effective tax rate: ~23%

Adjusted EPS growth: 8%–10%

Employer Services: revenue +5–6%; new business bookings +4–7%; client retention ↓10–30 bps; pays per control ~flat.

PEO Services: revenue +5–7%; ex-zero-margin +3–5%; average WSEs +2–3%.

Client Funds: revenue $1.3–1.32B; balances +3–4%; yield ~3.4%; net contribution $1.26–1.28B.

Condensed Financials

Total revenues: $5.175B vs $4.833B (+7%)

Net earnings: $1.013B vs $956M (+6%)

Adjusted EBIT: $1.318B (+7%), margin 25.5%

Effective tax rate: 22.5%

Average client funds balance: $34.9B; yield 3.3%

Balance Sheet Highlights (Sep 30, 2025)

Total assets: $54.3B

Cash & equivalents: $2.48B

Funds held for clients: $31.7B

Total liabilities: $47.95B

Stockholders’ equity: $6.37B

Cash Flow (Q1 FY26)

Operating cash flow: +$642M

Investing cash flow: –$1.86B

Financing cash flow: +$164M

Net change in cash: –$1.06B

Ending cash balance: $3.99B

Other Key Metrics

Employer Services margin: 35.2% (–50 bps)

PEO Services margin: 13.0% (–140 bps)

Average WSEs: 754,000 (+2%)

Pays per control (U.S.): flat

Client funds interest income: $287M (+13%)

Net impact from funds strategy: $264M (+29%)

Non-GAAP Adjustments

Adjusted EBIT: $1.318B vs $1.233B (+7%)

Adjusted EPS: $2.49 vs $2.33 (+7%)

Adjusted effective tax rate: 22.5%

Organic constant currency revenue growth: 6%

Company Overview

ADP serves over 1.1 million clients across 140+ countries, processing $3.3 trillion in annual payroll and taxes. The company maintains AA-/Aa3 credit ratings and has increased its dividend for 50 consecutive years.

Contacts

Investor Relations: Matthew Keating (973) 974-3037, Rebecca Koar (203) 882-7313

Media: Allyce Hackmann (201) 400-4583

Source: Automatic Data Processing, Inc. – October 29, 2025

Subscribe to our newsletter and never miss our latest digital HR news!

By signing up to receive DHRmap newsletter, you agree to our Terms of Use and Privacy Policy. You can unsubscribe anytime.